2024 Market Performance: Surpassing Expectations

In 2024 silver prices crossed a decade-long price ceiling, passing over $30 per ounce and catching the attention of investors worldwide. Investors can track these trends using live price charts for gold and silver.

The metal’s impressive 40% rally by October, which outpaced even gold’s strong performance, drove prices to $35 before settling around $32 in mid-December.

The powerful advance stems from a perfect storm of factors: robust industrial demand, a second consecutive year of substantial supply deficits, rapidly declining inventories, and renewed safe-haven buying amid inflation concerns and geopolitical tensions.

Silver Price Predictions for 2025

Leading financial institutions dedicate extensive resources to precious metals research.

Their silver forecasts – built on macroeconomic analysis, technical indicators, and supply-demand data – guide investment decisions for institutional investors and central banks worldwide.

While these projections draw from deep market expertise, investors should note that actual prices can deviate from even the most well-researched predictions. Here’s how major institutions view silver’s potential in 2025:

| Analyst/Firm | Silver Price Target | Time Frame |

|---|---|---|

| Citigroup | $40 | 2025 |

| JP Morgan | $38 | 2025 |

| Saxo Bank | $40 | 2025 |

| World Bank | 7% rise | 2025 |

| PricePrediction.net | $38.87 | End of 2025 |

| Alan Hibbard | $40 | 2025 |

| Alan Hibbard | $52.50 | 2026 |

| InvestingHaven | $48.20 – $50.25 | 2025 |

| InvestingHaven | $75 | 2027 |

| InvestingHaven | Peak price: $80 | 2030 |

Alan Hibbard’s 2025 Prediction

When asked about silver’s outlook in 2025, GoldSilver’s Lead Analyst Alan Hibbard shared his perspective:

“I’m expecting silver to return about 25% in 2025, putting it around $40. And I’m expecting 2026 to be the year that silver reaches an ATH above $52.50.”

Key Factors to Watch in 2025

Several interconnected factors will likely shape silver’s performance in 2025:

Industrial Demand

The increasing use of silver in various industrial applications, particularly in green technologies, is expected to be a significant driver of demand. Here are some key statistics highlighting the bullish outlook for silver’s industrial demand:

- By 2050, solar energy could account for approximately 85–98% of the current global silver reserves.

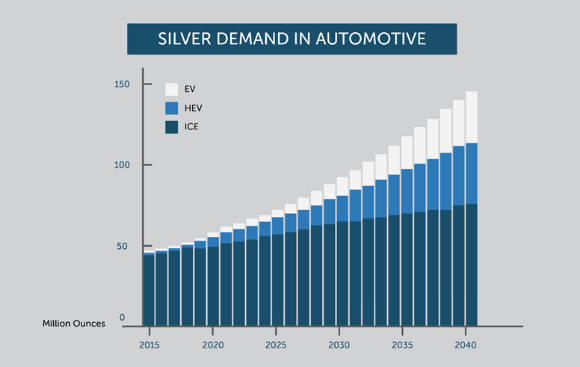

- The automotive sector is expected to contribute significantly to silver demand growth, benefiting from greater vehicle sophistication, rising electrification of powertrains, and ongoing investments in infrastructure such as charging stations.

Monetary Policy

Central bank decisions, particularly regarding interest rates, play a crucial role in silver’s performance. Expected rate cuts throughout 2025 could provide significant support for precious metals prices, including silver. Investors may also consider a self-directed IRA program for precious metals to further diversify their portfolio.

When interest rates are cut, the opportunity cost of holding non-yielding assets like silver decreases. This makes silver more attractive compared to interest-bearing investments such as bonds or savings accounts.

Investment Demand

Growing interest from central banks and institutional investors could boost silver prices. Russia’s recent announcement to expand its precious metals holdings with silver is a notable example.

The country plans to acquire $535 million worth of silver over the next three years, marking the first time any central bank has explicitly included silver in its purchasing plans during the current bull market for precious metals

Supply Constraints

The silver market faces significant supply challenges heading into 2025. Total silver supply has actually declined over the past decade, dropping from 1.07 billion ounces in 2010 to an estimated 1.03 billion ounces in 2024.

Meanwhile, demand continues to outpace production. The market has experienced consistent supply deficits since 2021, with 2023 recording a substantial shortfall of 184.3 million ounces. This trend is expected to continue, as 2024 consumption is projected to reach 1.21 billion ounces. With supply at only 1.03 billion ounces, this creates a significant deficit of 182 million ounces – a situation that could drive prices higher.

Geopolitical Factors

Global tensions and political uncertainties continue to influence precious metals markets, with Russia and Mexico – accounting for nearly 21% of global silver production – facing ongoing conflicts and regulatory changes. Current geopolitical risks in key mining regions could drive increased safe-haven demand, particularly given that Mexico’s recent mining reforms have already impacted approximately 5% of projected 2024 output.

During periods of heightened geopolitical tension, silver has historically demonstrated its safe-haven appeal, as evidenced by the 47% price surge during the 2020 global crisis.

Market Outlook

The outlook for silver in 2025 appears bullish, with most predictions indicating significant potential for price appreciation. The combination of growing industrial demand, particularly in green technologies, and potential supply constraints creates a favorable environment for higher silver prices.

Investors should pay close attention to:

- The pace of industrial adoption, especially in solar energy and electric vehicles

- Central bank policies and their impact on currency markets

- Developments in global political and economic landscapes

- Changes in supply dynamics from major silver-producing regions

Tracking Progress

As we move through 2025, it will be crucial to monitor these forecasts and analyze key market developments. The interplay between industrial demand, investment interest, and supply constraints will likely determine whether silver can reach the higher price targets set by some analysts. For a deeper understanding, explore Hidden Secrets of Money by Mike Maloney.

While expert predictions offer valuable insights, investors should remain flexible and attentive to changing market conditions. Silver’s dual role as both an industrial metal and a precious metal makes it particularly sensitive to a wide range of economic and geopolitical factors.